Under-the-table jobs might not be the best in terms of pay, but they’re still loved for one thing…Yeah, you got that right – Taxes.

They easily bypass taxes since there’s typically no way the government can track them. Even though this may seem illegal, is Doordash an under-the-table job? This article should answer every question you have.

Is Doordash under the table?

Well, the simple answer is NO.

Doordash is not an under-the-table job.

And to be honest, finding an under-the-table job is way more difficult than you can think unless you’re willing to go for odd jobs like errand person, babysitter, or cleaning jobs, which are not handled by a legal organisation, of course.

If you want to work for a legal organisation, for instance, Doordash, be prepared to pay taxes whether from your paycheck or having to pay it yourself.

For Doordash, however, Taxes are handled independently by dashers.

Now, don’t get me wrong.

It might be possible to find professional jobs that could still go under the table when paying employees. However, if they’re caught by the IRS, they’re faced with several penalties, which may include:

- The Employer or Manager would have to pay all taxes not paid by the Employees within the time of being under the table

- They risk being jailed. Of course, any job under the table is typically illegal.

But Doordash doesn’t remove taxes from a paycheck, maybe they could be regarded as an under-the-table?

While Doordash doesn’t remove taxes from dashers’ paychecks, just like every other food delivery platform, it treats them as independent contractors. This is something recognized by the IRS.

In other words, as a dasher, you need to file your taxes yourself.

Now, how do you go around all this? and is Doordash even worth it after these taxes? Let’s talk about this in the following section.

Doordash and Taxes: Understanding the system

Firstly, as we said earlier, it’s important to make mention that as a Dasher, you’re treated as an independent contractor, hence you need to file your taxes yourself.

To think of it, as an independent contractor, can you avoid these taxes? What happens?

Well, there are penalties that come with failing to pay taxes as a Doordasher. While we’ve already talked about this in a previous article, here’s an overview of them:

- You lose the ability to remove deductibles after getting caught

- You risk losing your passport if things get worse

- You’re charged a failure-to-file penalty which can be pretty much expensive

So, yeah, taxes are important, if you should keep dashing unless you want to be faced with penalties which you might not be able to bear.

But how do you pay these taxes?

Well, there are two basic approaches:

Work with an Accountant or Tax Professional

By this time, you should have gotten your 1099 forms.

This is because you would have to send it to a tax professional, alongside any other deductibles you think should be removed to make your taxable income. They should also help you suggest these deductibles though.

Editors note: The process of getting your 1099 form is almost automatic, as long as you’ve earned up to $600 so far, dashing. In November, Stripes should send you an email on how to create an account with them, followed by another on the 31st of January with your tax form.

Now an accountant or tax professional (whichever) should be able to guide you through the whole process and possibly answer any questions you may be having.

Quite easy, right? Yeah, but it would cost you money.

Use a Tax Software

To be honest, not everyone would want to spend extra money on having a tax professional taxes when they can actually do it themselves.

Well, turbo tax, a software for filing taxes, is one platform that can help you file your Doordash taxes yourself.

First time using Turbotax?

This is a video we recommend to get started on Turbo tax:

But generally, the whole idea of Turbo tax is to create a platform where you can file the details on your 1099 form on. It’s simply a digital system of paying your tax.

What is the income potential of Doordash and is it worth it?

Well, the truth about taxes is that you can’t bypass it, Doordash or not.

You’ll still need to pay it, regardless of where you work. However, not to deter, paying taxes as an independent contractor can be over sometimes, and we know about it.

So is Doordash worth it?

Generally, If you want to know if Doordash is worth it you’ll need to consider the time you put in compared to other available opportunities you have, the flexibility, and your financial goals.

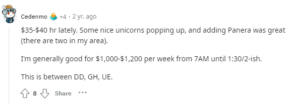

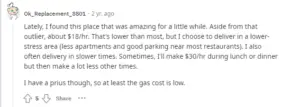

About the income potential, it basically depends on your Geo-Location.

If you stay in a location that is a bit populated, you might make more money than someone who is not in that same location.

Also, competition is something else to consider.

If there is more competition in a particular place, it simply means fewer orders for dashers.

Here are a few screenshots from redditers about their income:

Conclusion

While it might not be a real job as most people say, Doordash is not an under-the-table job. As a matter of fact, you’re required to pay taxes normally just like the case for every job you can get.