Over the years, car rentals have grown huge, especially in countries like the United States. It is to the extent that we now have almost a tie share of actual car owners and renters.

Turo, on the other hand, is one of the leading car rental companies, providing a marketplace where people can easily rent or book cars online.

Even though you can get a Turo car, pay the needed amount and begin driving…

Considering the fact that it is almost illegal to drive cars in the states without car insurance (or proof that you’re financially stable), you may want to get insurance on your Turo. Does Geico Cover Turo Car rentals? Do you think your insurance on Geico could extend to Turo? This article explains everything you need to know.

Does Geico Cover Turo?

Geico insurance doesn’t cover Turo. This is because Geico is wholly against providing insurance to peer-to-peer car-sharing platforms. A Geico insurance would only cover a car when it’s been driven and maintained by the owner, rather than lending it for commercial purposes.

Over time, we’ve seen several insurance companies dropping car-sharing platforms from their auto insurance policy and system.

While, on the other hand, car rental companies still have a handful of insurance programs that work with them.

Why is this so?

Well, you might think of Car sharing and the car rental industry as one, but they’re not.

While the car rental industry consists of independent companies, with fleets of cars on their network, renting cars to guest riders, Turo is more like a marketplace for car rentals (just like Airbnb), allowing hosts to display their cars for potential renters.

For no good reason, Insurance companies are not in support of the car-sharing business model, hence the reason why they don’t appeal to many car-sharing companies like Turo.

But is this the case for Geico? Read on to find out

For Guest (Renters):

Taking a look around several top rental companies like Enterprise, Alamo, and a few others, you’ll find out that Geico is all allowed there.

In fact, Geico confirmed this with an article:

…of which, the article ended with “it depends.”

Actually, it is a bit complicated.

Unlike some other car companies which could appeal to Turo, Geico simply doesn’t extend its coverage for Turo Guests, regardless of the type of insurance package you have with them.

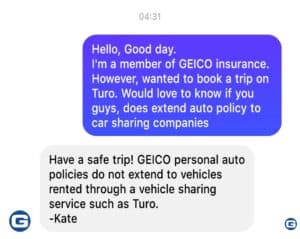

To confirm this, we contacted Geico.

According to the customer’s agent, Geico doesn’t extend auto insurance to vehicles rented through a vehicle-sharing system.

For this reason, Geico insurance won’t cover you as a Turo guest, regardless of the type of insurance package you have.

However, there are still some personal insurance companies that offer coverage for Turo.

For Hosts:

So, how about Turo Host?

The thing with insurance for Turo hosts is that you can’t use personal insurance as a Turo Host.

In fact, Turo won’t even allow you to switch between its inbuilt protection plan to something else, unless you have proof of commercial auto insurance.

But even at that, Geico’s insurance policy can’t be extended from an insured car to someone else when rented out.

The company’s insurance is only applicable to first-party drivers and also car rental companies since they’re being organized by a legal organization with qualified personnel.

Just like in the case of guests, you can’t use Geico as valid insurance on Turo. You’d only get yourself into problems, in the case of car damage.

What other alternatives work on Turo?

Normally, most popular insurance companies like progressive and Geico have limitations on peer-to-peer car-sharing services.

But are there any alternatives to this, or do you just have to stick with the company’s inbuilt protection plan?

Depending on whether you’re a Host or guest, there are a few other insurance alternatives to take advantage of.

Hosts

Generally, if you’re a Turo Host, to make it clear, you only have two insurance options:

- Turo’s protection plan

- Commercial Auto Insurance

At the in-house insurance for Hosts’ cars on Turo, there are 5 major packages, as listed below.

| Packages | Cost | Deductible |

|---|---|---|

| 90 Plan | 10% Of Trip Earnings | $2500 |

| 85 Plan | 15% Of Trip Earnings | $1625 |

| 80 Plan | 20% Of Trip Earnings | $750 |

| 75 Plan | 25% Of Trip Earnings | $250 |

| 60 Plan | 40% Of Trip Earnings | $0 |

If you choose to sign up for Turo host insurance, a percentage of the pricing of trips taken daily with your car would be deducted from your earnings, depending on the insurance package.

Generally, the higher the package of your insurance, the lower your earnings are per trip and the higher benefits you receive, insurance-wise.

Note that the numbers on the plan signify the percentage of earnings in a day a Host goes home with.

For instance, the 90 Plan simply means that totally all trips taken in a day, 90% of the earnings would be allocated to the owner (host), while 10% would be kept for insurance.

At the end of the day, in case of any incidence, the Turo protection plan (insurance) would provide up to $750,000 of third-party liability insurance.

However, it’s worth mentioning that this is a secondary plan, meaning that you’ll need to use any personal auto insurance package you have first before Turo comes into play.

For a better guide on this, do well to check our comprehensive guide on insurance for Turo Hosts.

For Guests:

As a Guest on Turo, if you want to get your trip insured, you can either subscribe to Turo’s insurance package or use third-party insurance (of course, there are still other third-party insurance that works on Turo).

For the inbuilt insurance from Turo, below is an overview;

| Minimum | Standard | Premium | |

|---|---|---|---|

| Cost | 18% of the trip price for trips costing more than $250, otherwise 25% with a minimum of $10. | 40% of the trip price, with a minimum of $12/day | 65 - 100% of the trip price with a minimum of $14/day. |

| Liability Coverage | The required minimum amount by the state | The required minimum amount by the state | Up to $750,000 |

| Deductible | $3,000 | $500 | $0 |

Minimum:

- Cost: 18% of the trip price for trips costing more than $250, otherwise 25% with a minimum of $10.

- Liability Coverage: The required minimum amount by the state

- Deductible: $3,000

Standard:

- Cost: 40% of the trip price, with a minimum of $12/day

- Liability Coverage: The required minimum amount by the state

- Deductible: $500

Premium:

- Cost: 65 – 100% of the trip price with a minimum of $14/day.

- Liability Coverage: Up to $750,000

- Deductible: $0

If this doesn’t work for you, you might want to stick to a third-party insurance

And yes, there are still a number of insurance companies that work for Turo, considering the company’s business model.

Some of them include:

So far, we’ve made articles for these insurance companies. You can tap on the link to read more about them.

Final Thoughts

Again, you can’t get insurance coverage on your Turo trip on rented cars from Geico.

If you’re a host, a better alternative would be to sign up for commercial insurance or the company’s protection plan.

On the other hand, as a guest, you either pay for Turo insurance plans or look for an insurance company that’d accept to cover Turo.