At first, Turo can be a bit interesting to guests, considering their relatively cheap pricing and the fact that they’re a P2P car-sharing company – at least there are no logos on cars.

However, when it comes to insuring a rented Turo car, things can get pretty bad when it appears that Turo’s insurance is almost the only available protection plan. But do you think you can insure Turo with a third-party plan? Does USAA insurance cover Turo?

Does USAA cover Turo?

From our personal research, your USAA personal auto insurance coverage could extend to your Turo rented car. However, there are policies guiding this.

The question of whether or not some insurance company covers Turo has always been a tough one. Even when we ask the agents of this company, they tend to put a lot of “But” and conditions.

But Why?

The straight-up answer is that Turo is not plainly a Rental Car company.

Turo is actually a Peer to peer car sharing company that acts more like a marketplace, linking hosts (car owners) with people who want to rent them for an amount, bargained.

This is unlike Rental car companies that own the car (not always though), regulate them, and store them, for potential customers (renters).

Insuring a rental car, be it the guest or Host is usually not a big deal here. But when it comes to peer-to-peer car-sharing companies like Turo, the case is different.

Thankfully, there are a few insurance companies like USAA that extend their coverage to peer-to-peer car-sharing companies.

While this is true, it doesn’t work for everyone. Hence, let’s go over USAA policy for Guests and Hosts in the following sections:

For Guests (Renters):

As we said earlier, answering the question of whether some popular insurance companies offer coverage for Turo is actually a tough one.

For USAA, however…

The simple answer is Yes. USAA can extend their coverage to a Turo rented car in a case where you have a personal auto insurance package with them. However, there are some conditions that need to be met.

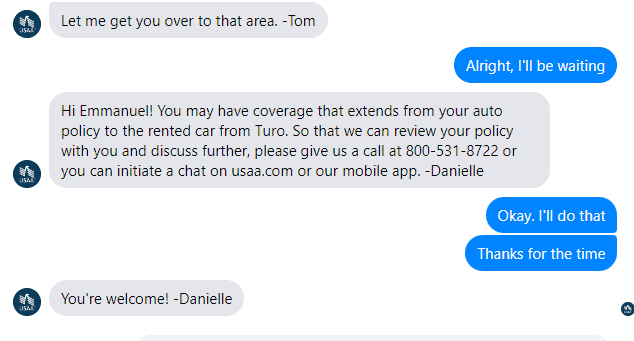

To verify our speculation of whether or not USAA covers Turo, we went overboard to message them on their page, on both Facebook and Twitter.

Fortunately, we got a response from them in a short time.

It’s a pretty Vague response, but however, did state that my USAA auto policy can be extended from my personal car to the rented car from Turo.

But for more clarification, we should call customer care, which I did.

Here’s what we found:

Yes, USAA could extend your auto insurance policy to the rented car on Turo, there are some conditions that follow, which are stated below:

- The location where you reside could be a determinant of whether or not the USAA auto policy would extend.

- The USAA auto policy only applies to a rented Turo car that is less in worth than the initial car insured – You can’t use an insured Highlander auto policy to extend to a rented Lambo.

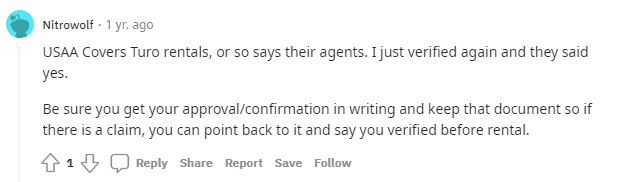

Again, here’s someone else on Reddit, indicating USAA coverage for Turo rentals.

Even though USAA appears to work for Turo, ensure to make a call with their agent, via the number 800-531-8722 for further explanation of their policy and most importantly, if your current location is viable.

Because there could be a situation whereby their service is limited to a particular area.

Also, before concluding on USAA covering Turo in your location, make sure to call USAA, as we said earlier, and get the auto policy in writing. So they won’t have any possible way to deny a claim in the future.

For Hosts (Owners):

Unfortunately, USAA doesn’t extend coverage for hosts.

According to USAA Auto policy, when an insured person allows a third party to rent or operate their personally-owned vehicle their initial insurance becomes ineffective.

Aside from that, you’re normally not allowed to use third-party insurance as a Host on Turo, unless commercial insurance.

You aren’t even given the option for that, funnily enough.

You can read our guide on the best insurance for Turo hosts, to properly understand how insurance for Turo works and what to do.

What other alternatives work? Do you need Additional Insurance?

For Hosts:

As we said earlier, you’re generally disabled from using any insurance package as a Turo host, other than the company’s owned insurance program or commercial insurance which would require registering your Turo fleet.

From our experience, there are typically two rules to follow when insuring your car on Turo as a host.

- Insure with Turo’s protection plan if you’re just starting out

- Migrate to Commercial insurance when you own a bigger fleet of cars

If you’re just starting your Journey on Turo, or you only own a few car, Turo’s protection plan would work best.

The protection plan is divided into 5 levels, starting from the most insured to the less insured:

- 90 Plan with a deductible of $2500

- 85 Plan with a deductible of $1625

- 80 Plan with a deductible of $750

- 75 Plan with a deductible of $250

- 60 Plan with 0 deductible

The number of these plans simply means the percentage of earnings a host would take back home in a day after the insurance has been removed.

For instance, the 90 Plan simply means that the hosts would only take 90% of the money they made in a day after the insurance fee has been subtracted.

We recommend taking the 60 plan if you’re just starting out, as we don’t want to spend money (probably the last money we have) on insurance at this stage.

You could then migrate to the 75 plan; which has good benefits, with a relatively average deductible.

For Guests:

As a guest, as long the auto insurance company you’re on (in this case, USAA) agrees to cover your Turo trip, there’s no cause to fret. You’re covered.

However, make sure to get any policy written to avoid denial claims.

If you choose to, you could also get the Turo protection plan. This, however, would depend on your decision, as there is typically no added advantage.

Below is an overview:

| Minimum | Standard | Premium | |

|---|---|---|---|

| Cost | 18% of the trip price for trips costing more than $250, otherwise 25% with a minimum of $10. | 40% of the trip price, with a minimum of $12/day | 65 - 100% of the trip price with a minimum of $14/day. |

| Liability Coverage | The required minimum amount by the state | The required minimum amount by the state | Up to $750,000 |

| Deductible | $3,000 | $500 | $0 |

Read Also: Does Geico insurance cover Turo Rentals?

Final Thoughts

Apparently, we’ve seen USAA agree on the fact that they can extend your auto coverage to a rental company like Turo in the case of any. But, however, this only applies to guests and not Hosts.

Also, make sure to get validation from USAA of this at the location you intend to travel with the rented Turo car. Lastly, make sure to get a written agreement.